Not known Facts About Personal Loans copyright

Not known Facts About Personal Loans copyright

Blog Article

Some Known Factual Statements About Personal Loans copyright

Table of ContentsAbout Personal Loans copyrightThe 15-Second Trick For Personal Loans copyrightNot known Facts About Personal Loans copyrightExcitement About Personal Loans copyrightThe Ultimate Guide To Personal Loans copyright

Doing a normal budget plan will certainly give you the self-confidence you need to handle your money efficiently. Excellent points come to those who wait.Saving up for the big points implies you're not going right into financial debt for them. And you aren't paying a lot more over time due to the fact that of all that rate of interest. Count on us, you'll take pleasure in that household cruise or play area set for the youngsters way extra recognizing it's currently spent for (as opposed to making payments on them up until they're off to university).

Nothing beats tranquility of mind (without financial debt of course)! You do not have to transform to individual finances and debt when points get tight. You can be cost-free of debt and begin making genuine traction with your cash.

A personal finance is not a line of credit score, as in, it is not rotating financing. When you're accepted for an individual lending, your lending institution gives you the full quantity all at as soon as and then, normally, within a month, you start settlement.

Getting The Personal Loans copyright To Work

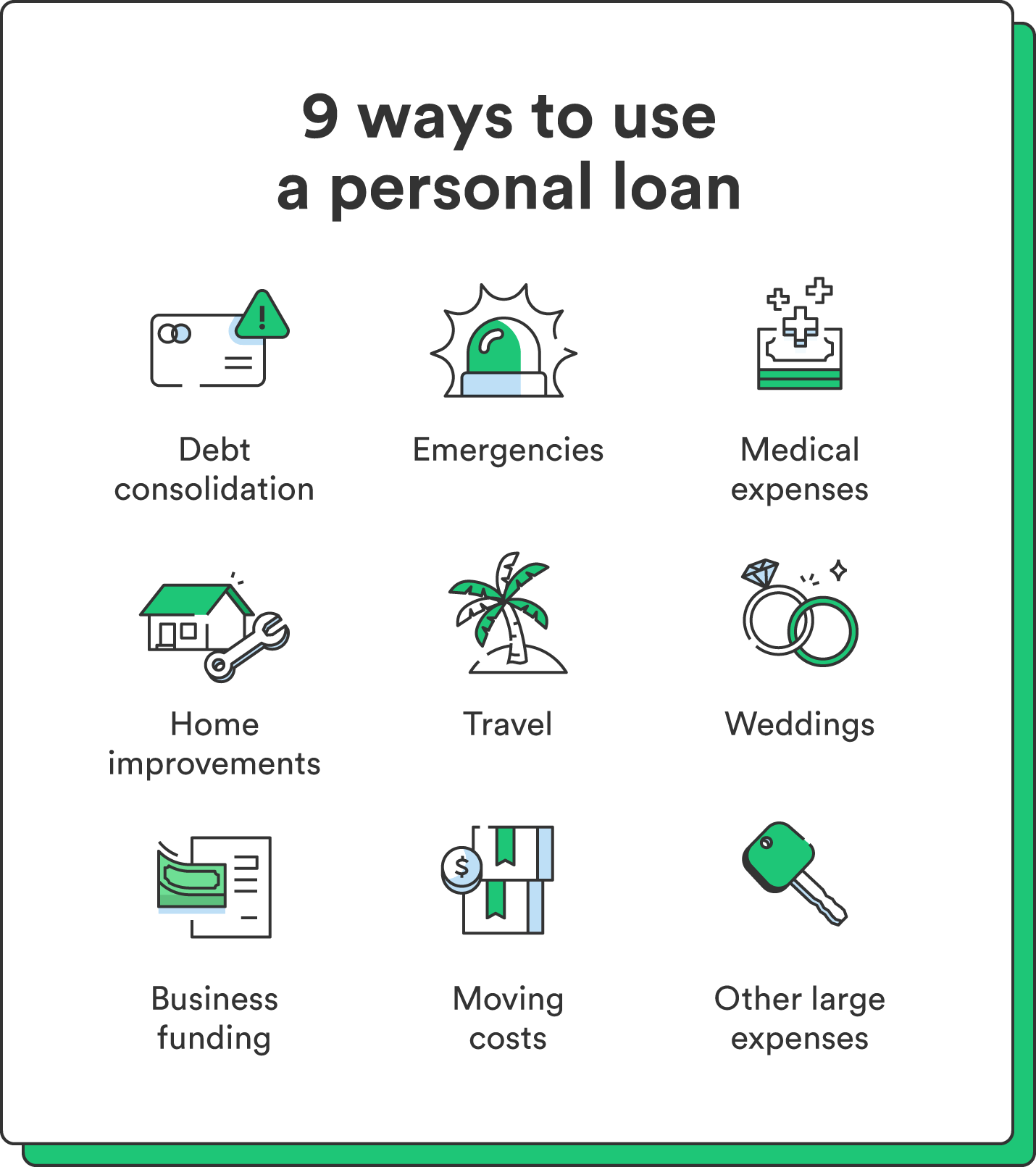

An usual factor is to consolidate and merge financial obligation and pay all of them off simultaneously with a personal loan. Some financial institutions placed terms on what you can use the funds for, yet numerous do not (they'll still ask on the application). home enhancement financings and restoration fundings, car loans for relocating expenses, trip car loans, wedding financings, medical fundings, cars and truck fixing car loans, fundings for lease, little automobile financings, funeral loans, or other bill repayments in basic.

The need for individual finances is climbing amongst Canadians interested in escaping the cycle of payday financings, combining their debt, and restoring their credit scores score. If you're using for an individual lending, below are some points you ought to keep in mind.

Some Ideas on Personal Loans copyright You Should Know

Additionally, you could be able to minimize just how much complete rate of interest you pay, which implies even more money can be conserved. Individual car loans are effective devices for accumulating your credit report. Settlement history make up 35% of your credit report, so the longer you make routine repayments on schedule the more you will see your rating increase.

Individual hop over to these guys financings supply a great chance for you to rebuild your credit history and settle financial obligation, yet if you don't budget plan properly, you could dig yourself into an also much deeper hole. Missing out on among your regular monthly repayments can have a negative impact on your click this site credit report score but missing out on several can be ruining.

Be prepared to make every solitary payment in a timely manner. It holds true that an individual lending can be made use of for anything and it's much easier to get accepted than it ever was in the past. Yet if you do not have an immediate requirement the extra cash money, it may not be the ideal service for you.

The dealt with month-to-month repayment amount on a personal car loan relies on just how much you're borrowing, the rates of interest, and the set term. Personal Loans copyright. Your rate of interest will rely on elements like your credit rating and income. Many times, individual loan rates are a lot less than bank card, yet sometimes they can be greater

The 7-Minute Rule for Personal Loans copyright

Advantages consist of excellent rate of interest rates, exceptionally fast processing and financing times & the anonymity you might want. Not everyone likes strolling right into a bank to ask for cash, so if this is a tough area for you, or you simply don't have time, looking at online loan providers like Springtime is a terrific alternative.

Payment lengths for individual car loans normally fall within 9, 12, 24, 36, 48, or 60 months (Personal Loans copyright). Shorter repayment times have extremely high monthly settlements yet after that it's over quickly and you don't shed even more cash to interest.

See This Report about Personal Loans copyright

Your rate of interest price can be connected to your repayment period too. You might obtain a lower passion price if you fund the loan over a shorter duration. A personal term financing features a set settlement timetable and a dealt with or drifting rates of interest. With a drifting rate of next page interest, the rate of interest amount you pay will fluctuate month to month based on market changes.

Report this page